Survey: Advantages Show The major Missed Financing Layouts To target Through the 2025

Before you can place your money for the stock market or other opportunities, you’ll need a simple comprehension of how to dedicate your money the right way. Funding executives might help ensure a highly varied profile, and can be useful whenever investing large amounts of money inside various other resource kinds. Investment administration is the provider from managing a customer’s assets, as well as allotment, exchanging, or other kinds of handling. High-risk investments are those with a relatively large chance out of winding up which have a loss of profits. Rubbish securities, such as, bring an elevated than simply mediocre risk that the giving business usually standard.

#4 Bending Portfolio To the Circles (Time, Technology, Healthcare)?

Quicker investment financial institutions for example Greenhill & Co. (GHL) and you may https://www.unbelievable-poker.com/casino-online-software-what-it-takes-to-develop-a-high-performing-solution/ Guggenheim Partners and sometimes work on one business, including health care. The new investment bank’s consultative part starts with pre-underwriting guidance and you may continues on pursuing the shipment from bonds. If you’re able to respond to all 15 of your concerns within this post, you may then features a real investment allowance. Please inquire such questions with other white layer buyers inside the real world plus our communities. Might found of many feedback, but in the conclusion, you’ll need to go for on your own.

Missed funding ideas to think

Shared money make it investors to find a large number of investment in one exchange. These types of financing pond money from of several investors, then use a professional movie director to pay that money inside the holds, securities or other assets. Money banking companies features research departments you to opinion businesses and you will generate records about their applicants, often which have purchase, hold, or promote ratings. This research might not create revenue in person but it helps the fresh bank’s investors and you can conversion process company. The sales company typically oversees the fresh buying and selling from economic items such holds, bonds, commodities, and other securities.

In essence, you’re investing in the fresh results from dozens, or even numerous, away from brings, which is far more a bet on the market industry’s results. Income-concentrated investors are looking to secure rates of interest before the Provided lowers her or him then. Rental houses is an excellent financing for very long-identity buyers who wish to do their own functions and you will create typical cash flow. We have been an independent, advertising-supported evaluation solution.

Financing Strategists is a respected economic training company one connects anyone that have monetary benefits, priding in itself to the taking direct and you may credible monetary suggestions to many out of members each year. Roi are an excellent metric you to evaluates exactly how much well worth might have been attained out of a financial investment prior to the price. Including, should you have ordered a secured asset to own $one hundred plus the worth values so you can $120, then you’ve got attained $20 value of well worth to have a keen Bang for your buck of 20%. Select short-cap stocks that have restricted express drift and you can self-confident speed energy. People will also be capable enjoy the new food and drink possibilities, starting from basics from the superstar cooks Scott Conant and Marcus Samuelsson in order to regional basics reflecting the fresh culinary depth from Queens.

Adhere your own package rather than selling considering the view out of what the results are soon. One of the primary grounds of several buyers have lowest productivity is actually while they offer at the incorrect go out. Of a lot investors usually buy things having liked in the value market points that has refused in the worth. A thread are a debt device symbolizing financing made by a trader so you can a borrower.

It can construct and keep a collection out of inventory and you will bond-dependent list finance made to maximize your return possible while maintaining their risk level suitable for your needs. A risk-averse individual that desires to make discounts build without it struggling with rising cost of living you will believe committing to ties otherwise genuine house. On the other hand, someone with a high-chance endurance get like investing brings.

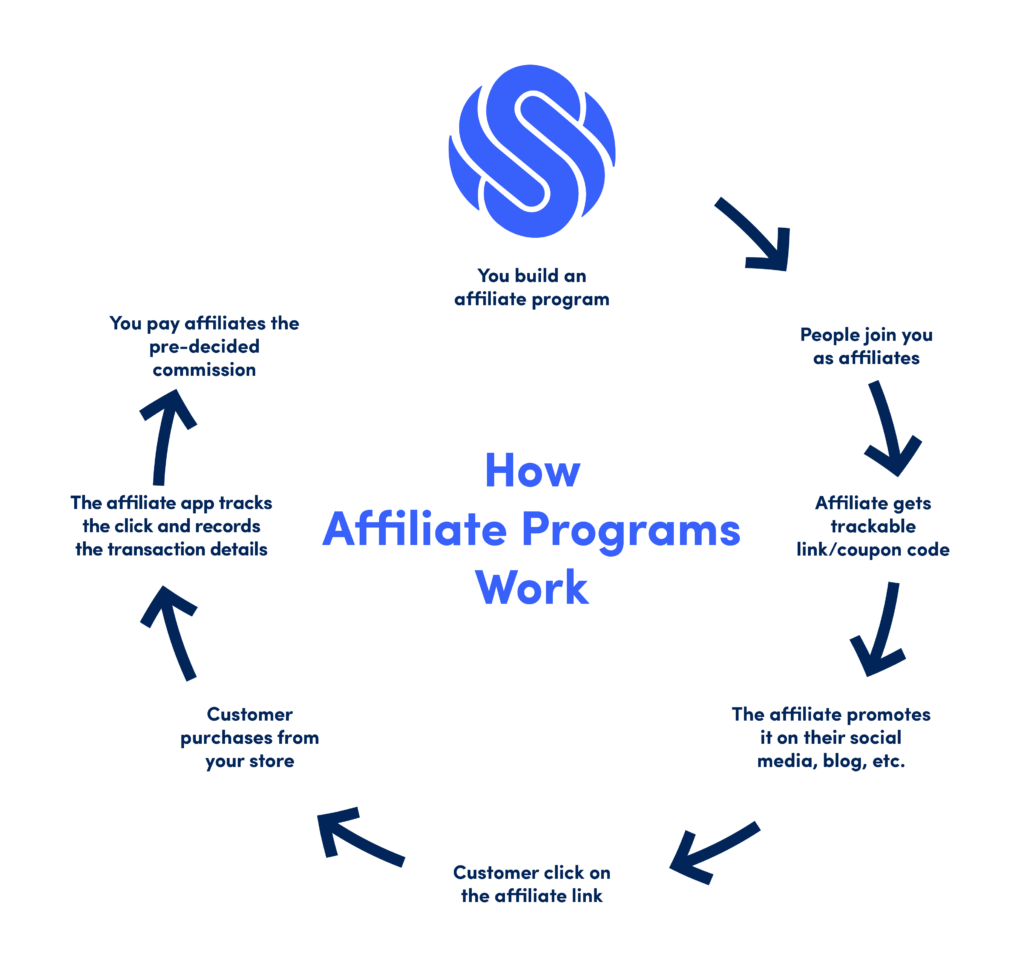

Our very own mission would be to encourage clients with the most informative and you can legitimate economic guidance it is possible to to help them generate told choices for the personal means. From the Financing Strategists, i companion which have fiscal experts so that the accuracy of our own financial posts. Fund Strategists features a marketing experience of some of the enterprises provided on this site. We might secure a payment once you simply click an association otherwise make a purchase through the website links to the our web site.

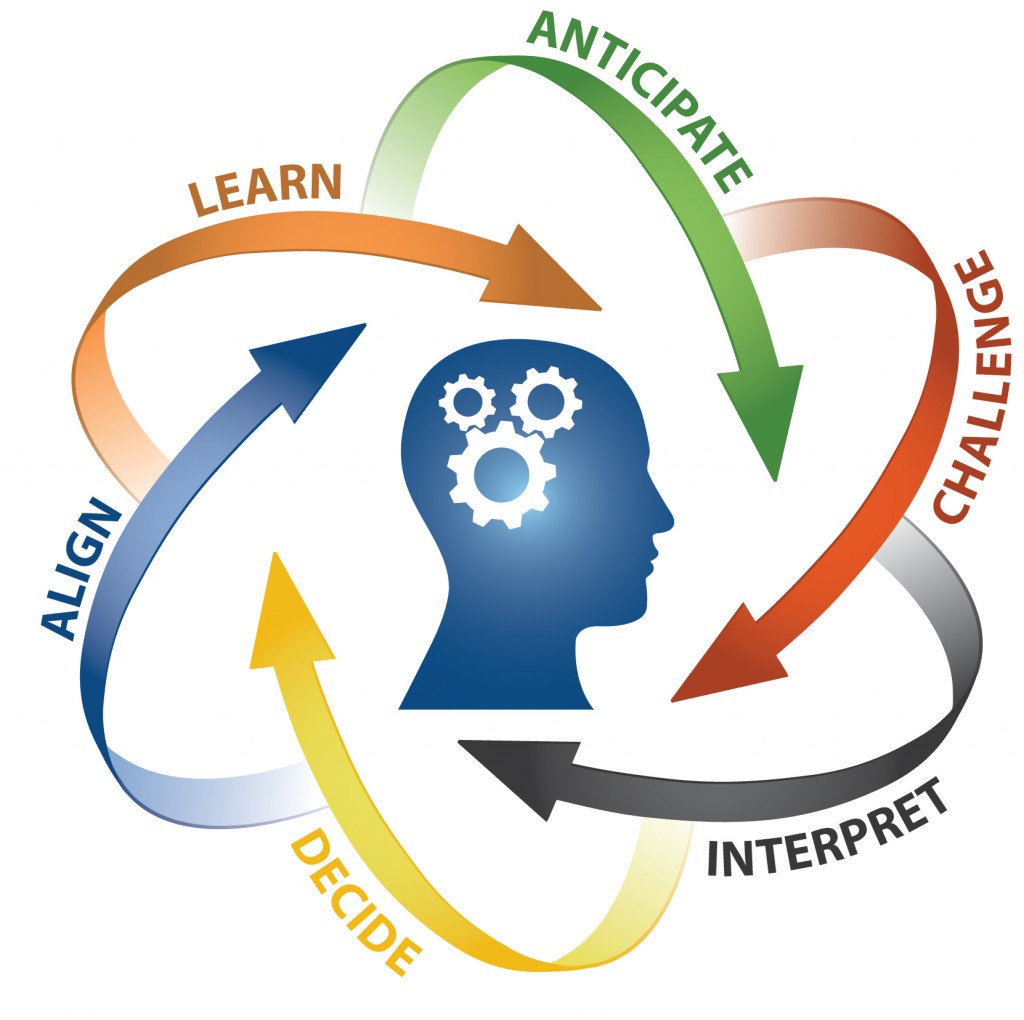

A diy approach will require making typical deals and you will making sure yes your own assets remain on tune (re-balancing). A robo-coach (automatic spending) will definitely cost a bit more than doing something on your own nevertheless won’t be since the date-intense. Christopher Liew a certified Monetary Coach and the maker of Wide range Super demonstrates to you this is always something you should keep in mind.

- You may want to invest currency to call home from after you retire inside the thirty years roughly.

- Most common fund have a minimum money from anywhere between $500 and you will $5,100000, and many lack one lowest at all.

- One way away from studying the chance vs. prize tradeoff is through a thought known as the “equity risk superior” (ERP).

- Products are used for hedging exposure or speculative motives.

We go after rigid assistance to ensure that our very own article blogs is actually perhaps not influenced by advertisers. Our very own editorial people gets no lead payment of advertisers, and you can our very own content are very carefully fact-searched to make certain reliability. So, if your’lso are learning an article or an evaluation, you can rely on which you’lso are taking credible and you will reliable information. Bankrate follows a rigid editorial policy, so you can trust that we’re placing the welfare basic.

Thus there is absolutely no doubt that it is well worth some time to find away how it all performs. The greater currency you could potentially dedicate, the much more likely they’s going to be convenient to research large-exposure, higher-come back investment. The best assets to possess 2024 allows you to create both, which have different quantities of risk and you may get back. Bankrate’s AdvisorMatch can also be hook up one an excellent CFP professional so you can reach finally your economic wants. Our pros were assisting you to grasp your money for over four many years.

Now that you know what type of membership you want and you will you have selected a free account merchant, you should actually open the brand new account. Some profile give taxation benefits if you purchase to possess a specific mission, such as old age. Keep in mind that you’re taxed or penalized in the event the you pull your money away very early and an explanation perhaps not sensed licensed by the bundle legislation. Almost every other accounts try general purpose and really should be taken to possess requirements unrelated so you can later years — one to fantasy trips family, including.

To your rising prices calculator, you should check simply how much their discounts can be worth inside an excellent while. While you are happy to set most of these novices paying tips to a good have fun with, see a good investment platform. While you are wondering which one to decide, we could assistance with one. This is how charges impact gains on the a $ten,100 very first money with an excellent $3 hundred month-to-month contribution to have thirty years (assumes an income of five.48%). Using is exactly what occurs when at the conclusion of the newest few days, pursuing the expenses try repaid, you’ve got a number of bucks left-over to put to your upcoming. How are you supposed to come across those elusive additional cash so you can help save?